GST – A Slow & Unsteady Pick Up

The GST net is steadily widening. The collection in FY1718 has been Rs 7.41 lakh crore in the period from July 2017 to Mar 2018. There was considerable concern that GST revenues were falling short of expectations and the impact it would have on the economy. Even the uptick in April 2018 was hedged with caveats that the revenues might not stay over the Rs 1 lakh crore per month figure achieved. However, the operational side is showing a steady, if slow and uneven, improvement.

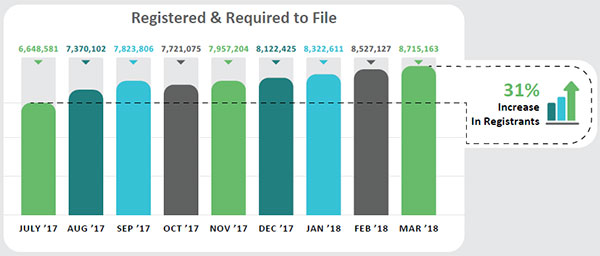

More people are getting into the tax net

The number of people who are registered and required to file GST returns has been on a steady increase from 66.4 lakh in July 2017 to 87.1 lakh in March. This is a 31% increase in 8 months. This is probably a combination of a better understanding of the system and ease of filing, coupled with a pressure for compliance.

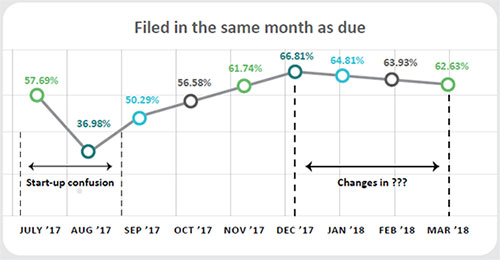

Teething troubles are getting addressed, but it’s not over yet

System difficulties are to be expected in a such a complex and fundamental change in the taxation model. The entire change was complex enough to require a constitutional amendment and needed to alter over 70 years of law making. So, it is not surprising that compliance has been difficult. Filing by the due date in the month it is due has been rising, but not steadily. This is an indication that there are still uncertainties and issues to iron out. The repeated changes and clarifications issued have left people confused. While the same month filing has moved from the 55% level to the 65% level, it has flattened out or declined in the last 3 months. There is more work to be done here and it is being addressed step by step.

As issues are sorted out, compliance is improving

However, people are working to get it right. This can be seen when the cumulative filing data is studied. With time, people are getting clarifications and filing their returns. So, while July 2017 saw only 57% of on time filings, if you take delayed filings into account, the number jumps up to 96% compliance. Not bad.

With the stabilization of the GSTN, greater clarity on various situations and, finally, with experience, the total compliance level should steadily rise. The operational benefits that are already evident in transportation (with occasional hiccups), should also translate to more buoyant tax revenues.

Indirect taxes have be en steadily rising in the past 2 years. After the demonetization and the GST roll out, the economy needs a period of fiscal policy stability to get back on track. It is also important that there is no backtracking on the principles of GST - this is currently being debated for the sugar industry.

What does this mean for companies in India?

How does this affect you and your company? It augurs well.

- The Government finances will improve, reducing borrowing from the market that might cause interest rates to rise & demand to drop. That’s good news.

- Infrastructure spends are likely to increase. Leading to a pick up in demand.

- The tax base will widen, reducing the dependence on taxing a narrow base, leading to more demand.

If things continue down this track, companies are likely to see demand accelerate in 2019 and need to get prepared with increased capacity and longer distribution networks.

25eb.png?width=203&name=CGN_Tagline1%20(1).png)