Finally, GST is here, and its implementation is round the corner starting next financial year. A lot has been discussed about its impact on the overall supply chain. In the last month newsletter, we discussed GST implication for the warehousing industry. At the same time, it will have an enormous impact on the transportation industry. Will it have a positive influence on the transportation sector? What do companies need to consider before it comes into effect?

Double Positive Impact

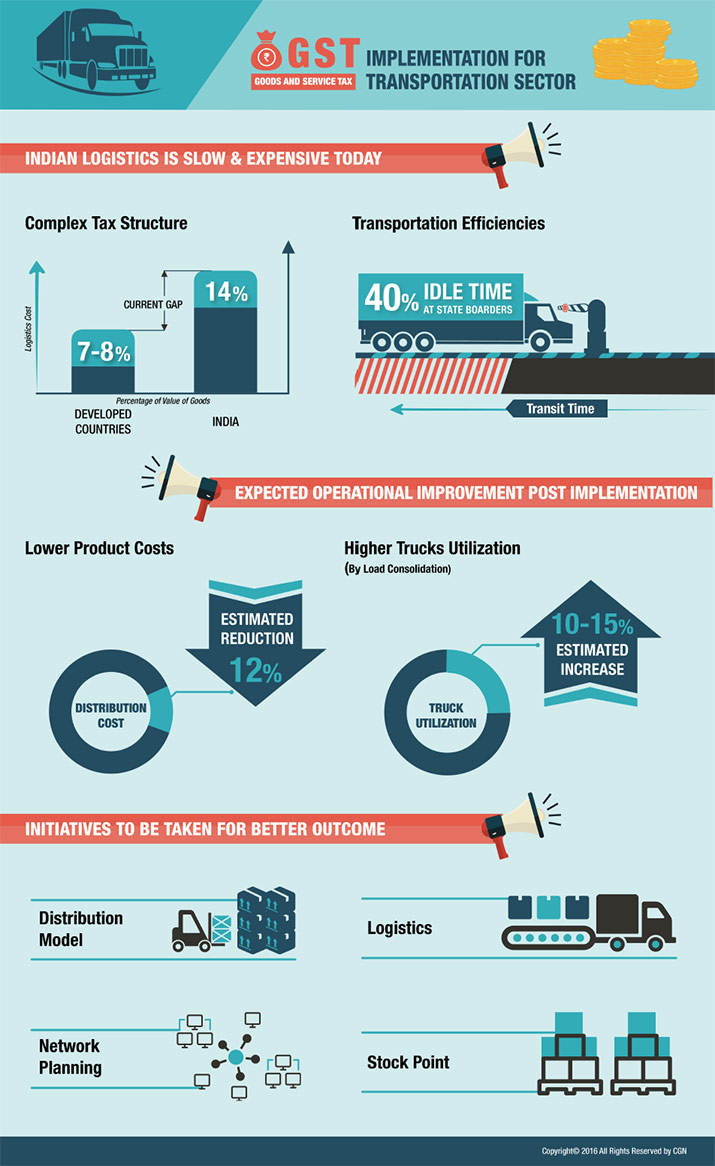

A complex tax structure and poor infrastructure have increased the logistics cost to 14% of the value of the good in India vis-à-vis 7-8% in developed countries. GST will eliminate the multiple state taxes and hence, lower inspection time at various check posts on state-borders. This will simplify the transportation between any two points in India at a lowest possible cost.

• Efficiency of Transportation

GST should ease the interstate movement of goods due to minimal obstructions at state-border check posts. In the present situation, inspection happens at these points for the location-based tax compliance. This leads to increase in the overall transit time. On an average, trucks are idle for about 40% of the total travel time due Central Sales Tax / Octroi payment. The cut down on the transport hassles after GST implementation should make the deliveries faster, and therefore, a truck can make a higher number of trips per annum and hence lower cost per trip.

However, while negotiating with the service providers for the transportation contracts, we are not seeing the cost coming down. Transporters are not very clear about the GST scenario and it is difficult for them to buy the logic of hassle free transportation.

• Higher Utilization of Trucks

Practically, after GST implementation companies will get away from the individual warehouses in each state. For FMCG/ consumer goods companies, the number of warehouses should come down to 17-18 from a present number of 25-26 warehouses. This means overall inventory will be positioned at bigger warehouses. As a result, utilization of trucks will increase by 10-15% because of consolidated loads on the primary routes. This will lower down the warehousing cost due to lesser space requirement and transportation cost due to lesser trips and higher utilization.

Higher Distribution Cost

On the other hand, distribution cost is likely to go up. As service-levels are paramount for the companies in today’s world. Therefore, centralized warehousing means part load shipments for the secondary distribution. Hence, it would be imperative for the companies to come up with innovative ways of secondary distribution. Otherwise, it will offset the cost reduction achieved in the primary leg of transportation.

All in all, the final product cost may or may not come down. The tax incidence of 28% is likely to be higher than the current rate applicable. At the same time, reduction in the warehousing and primary transportation benefits may offset by higher distribution cost. Moreover, the inability of the suppliers understanding on GST might hamper the estimated benefits. Overall, it is that GST will bring rejoice for the logistics sector in the long term. The transportation companies should know the new tax regimes and plan their future strategy accordingly.

REFERENCES:

http://www.careratings.com/upload/NewsFiles/SplAnalysis/Impact%20of%20proposed%20GST%20on%20Indian%20logistic%20industry.pdf

http://www.gstindia.com/discover-how-gst-will-transform-the-transport-logistics-sector-in-india/

http://techstory.in/gst-bill-logistics-industry/

Something we found interesting

"Here is an interesting article on overall business implications of GST across different functions"http://redseerconsulting.com/system/files/Taking%20Advantage%20of%20GST.pdf

25eb.png?width=203&name=CGN_Tagline1%20(1).png)