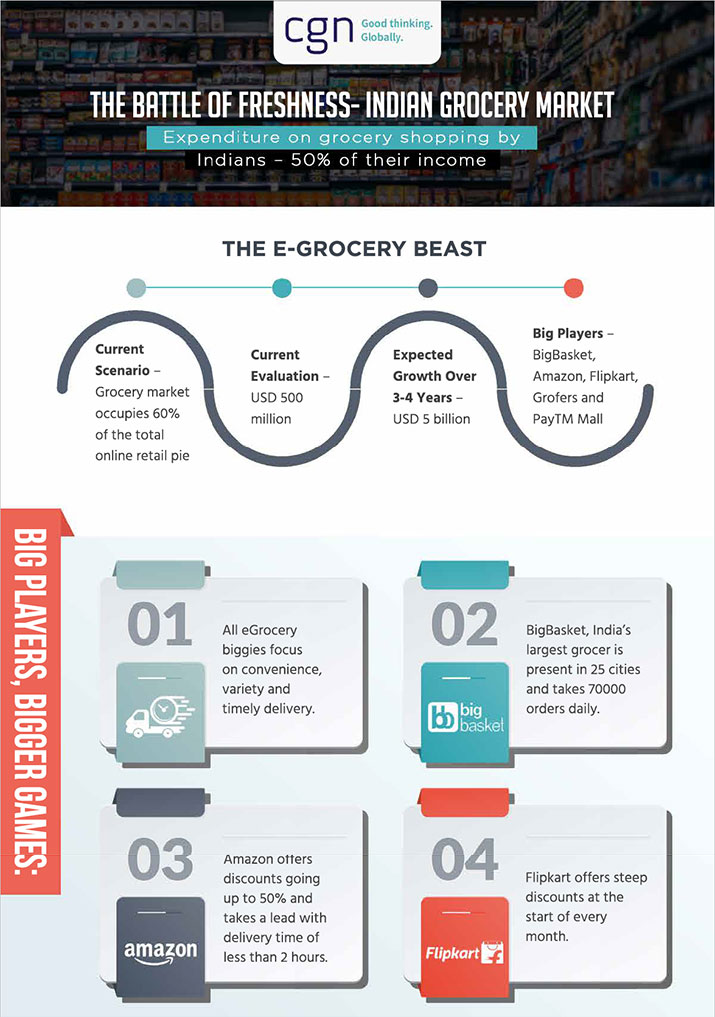

The past decade has seen tremendous surges in mobile connectivity and internet access that has given birth to an app culture – from taxis to ordering food, we have outsourced almost every aspect of our waking lives to apps! Grocery shopping has traditionally been an unavoidable chore that Indians spend close to 50% of their monthly income on. With the advent of e-commerce grocery, people are more than happy to have fresh veggies and fruits delivered to their doorstep at the click of a button!

The Nature of the e-Grocery Beast

The grocery market occupies 60% of the total national retail pie. Currently evaluated at $500 million, the online grocery industry is expected to leapfrog to the $5 billion mark over the next 3 -4 years. The numbers have certainly caught the attention of some very big players like BigBasket, Amazon, Flipkart and PayTM Mall.

Success is dictated by ability to provide convenience, price and variety. Moreover, ‘stickiness’ (frequent repeat purchase by same customer) is assured due to the ever-present need for groceries. This niche segment requires companies to have nimble and ecient supply chains, low margins, reliable logistics and technology levers to remain competitive.

Home-grown grocery goodness!

BigBasket is India’s largest e-grocer with a presence in 25 cities and 70000 orders per day. CEO Hari Menon attributes the company’s phenomenal growth to fresh produce, competitive pricing, wide variety, strong farmer connect and private label dierentiation (40% of their total business comes through private label products). With Alibaba’s recent investment of $200 million, the company stands valued at a whopping $950 million; as they say, proof of the pudding lies in the eating!

Several other players like Grofers, PayTM Mall and city-specic ventures like Bangalore’s DailyNinja and Trivandrum’s Kada are notable competitors who are all vying for a bigger share of the market. Though the e-grocery industry is certainly on the upswing, not all have been succ e s s f u l . Some high prole players like PepperTap and LocalBanya have been unable to keep pace and have closed shop.

Big Players, Bigger Games

E-commerce giant, Flipkart is also throwing their hat into the ring by targeting customers that shop at the start of each month with steep discounts. Amazon launched their online grocery shopping app in June 2016, called Amazon Now (previously Kirana Now) and are oering a wide range of products such as household essentials and personal care along with groceries. With delivery lead times of less than 2 hours and discounts going up to 50%, Amazon proves to be an aggressive presence on the scene. Specialized fullment centres with cold storage facilities for perishables and weekly/monthly stock-up through Amazon Pantry provides Amazon crucial supply chain leverage. With a recent government approval for $500million in food investment, Amazon is also sizing up the possibility of physical stores along the lines of supermarkets.

With street-corner kiranas, still ruling the roost of the Indian grocery market, e-grocery companies with lean and eective supply chain strategies, long term investment and focus on the convenience, variety and timely delivery aspects of their business can certainly ride the glorious wave of online retail with immense success!

25eb.png?width=203&name=CGN_Tagline1%20(1).png)