The Consumer Packaged Goods (CPG) industry is facing huge challenges with volatile commodity prices. Customers are highly sensitive to product pricing. Customer behavior and needs have considerably changed, due to a preference for healthier foods, high sustainability, transparency and decreasing brand loyalty. The industry is also experiencing limited pricing power; due to retailer consolidation. Amazon’s purchase of Whole Foods, along with Walmart’s purchase of Jet.com, have broadened their horizons, by operating retail stores and ecommerce respectively. Rising commodity prices, customer price sensitivity, changing customer behavior, and retail consolidations have resulted in lower profit margins. To improve margins, CPG companies should not only focus on cutting costs, but also on the following areas to be innovative, remain competitive and drive growth.

Digital transformation: Digital technology has influenced customer behavior and allows CPG companies to engage with customers on a more personal level. Many CPG companies are relying on digital marketing to connect with customers, understand customer behaviors and preferences, and promote their brand. Very few businesses have started down the path to digital transformation, eliminating tremendous opportunity from directly engaging with customers. Using digital technology for CPG holds several advantages, including, but not limited to, e-commerce, digital marketing, managing customer relationship, big data analytics, location based services, and digitally managing entire supply chain activities, from order processing to fulfillment. Companies are utilizing location based services to collect real-time data on customer locations, from their mobile devices, and wearables, to offer nearest store information, proximity based advertising and product promotions, and weather and travel information.

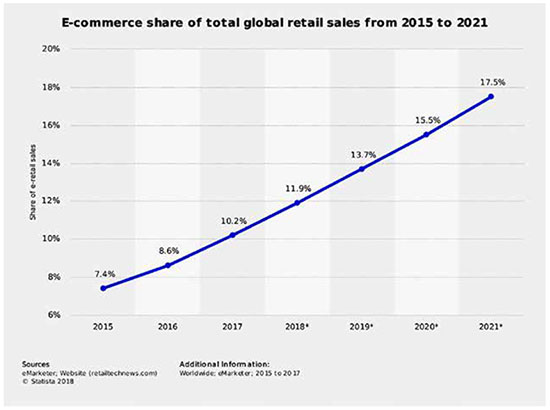

Omni-Channel: Increasing online sales and intense competition have led CPG companies to look for new ways to sell their products, in addition to the traditional retail route. Omni-channel is an integrated business model to satisfy customers with a seamless shopping experience, across multiple channels including, online, in-store, and mobile. As CPG companies continue to expand globally, the traditional retail infrastructure is not extensively available in developing countries, requiring set up of ecommerce preferred way to sell. CPG companies are continuing to partner with retailers to sell their products online, specifically through the retailer. To establish connections and build relationships with customers, CPG companies also prefer to sell directly to customers (DTC) vs. selling through retail. Unilever acquired Dollar Shave Club to sell shaving products directly to customers. In the near future, CPG based companies will need to establish a cost effective and agile omni-channel supply chain to increase product distribution at a more cost-efficient rate. CGN Global collaborated with a global sweetener vendor, who operated an omni-channel supply chain to optimize their product distribution network and improve their operating capacity, resulting in EBITDA of $31 million.

Figure 1: E-commerce share of total global retail sales from 2015 to 2021 (Source: eMarketer)

Figure 1: E-commerce share of total global retail sales from 2015 to 2021 (Source: eMarketer)

Customization & Personalization: Henry Ford famously said, “A customer can have a car painted any color, as he wants, so long as it is black.” With increased customer preferences, such as ingredients, flavor, pack size, color, and rapid advancement in technology, customers are looking for customized products and services. CPG companies should shift their focus from mass economic production, to developing customer centric marketing and delivering customized products and services. Companies collect large amount of data on their customers, but are not yet effective enough to channel customer preferences into greater product customization and more return business. This can only be achieved through understanding customer preferences and making technological advancements, such as artificial intelligence, data analytics, inbound marketing and automation to deliver personalized marketing content to customers.

Global expansion: CPG global expansion, especially to developing countries, could easily generate growth. As growth in developed countries continues to stagnate, growth in emerging countries continue to increase. Additionally, developing countries are seeing greater significant increases in the middle class than developed markets. To expand globally, CPG is using various strategies such as M&A or partnerships with local brands. A strategy for expansion into new markets should include introducing new products aligning with local customer preferences. For example, Unilever offers various local brands under food and drink, home care, and personal care categories in India.

Finding the right partner to lead the way The four areas listed above are just the beginning of the new CPG landscape. To succeed in the new CPG environment, businesses will need a firm with the speed and agility necessary to meet these high demands. CGN has extensively worked with various clients in retail and consumer goods such as Kellogg’s, Mondelez International, Kraft Heinz, Coca-Cola, Estee Lauder and T a t a Tea, guiding growth and improving their bottom-line. Based in the Americas, Europe and Asia, CGN is the trusted advisor to Fortune 500 companies, with a proven track record of innovating and transforming global brands towards increased stability, greater revenue, and overall competiti

© 2020 CGN. All rights reserved.